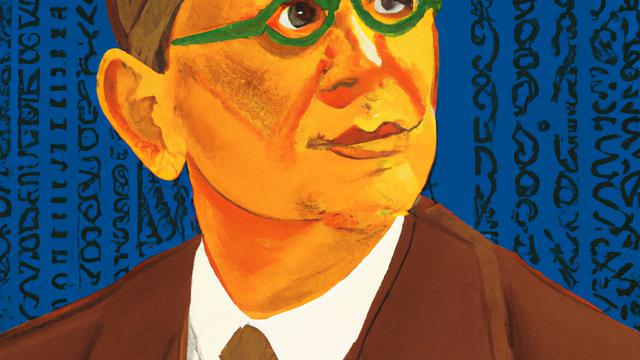

Who Was Jesse Livermore: Unraveling the Enigmatic Mind of Wall Street's Most Legendary Trader and His Enduring Legacy

Jesse Lauriston Livermore (1877-1940) was a legendary American stock trader and investor who gained fame and fortune through his remarkable market speculations during the early 20th century. Known for his keen intuition and understanding of market psychology, Livermore was one of the most influential and successful traders of his time.

From Rags to Riches: The Remarkable Early Life of Jesse Livermore, Wall Street’s Trading Prodigy

Jesse Livermore, a name synonymous with stock market success and trading mastery, did not have an easy start in life. Born in 1877 to a poor farming family in Shrewsbury, Massachusetts, young Jesse showed a rebellious streak early on. Dissatisfied with the limitations of farm life and driven by a strong desire to escape poverty, he ran away from home at the tender age of 14.

Shrewsbury’s Hidden Gem: Uncovering the Roots of Jesse Livermore’s Wall Street Success in 1877 Massachusetts

Life in Shrewsbury and other rural towns during the 1870s was characterized by a predominantly agrarian lifestyle. Most people were engaged in farming and related activities, with agriculture being the backbone of the local economy. Small-town life was relatively simple and less dynamic compared to the cities.

During this period, the United States was undergoing significant changes as it transitioned from an agricultural society to an industrial one. The industrial revolution, which had begun in the late 18th century, was in full swing, transforming the country’s economic landscape. However, the impact of these changes was less pronounced in rural areas like Shrewsbury, where people continued to rely on farming for their livelihoods.

In the 1870s, there were no modern conveniences like electricity, running water, or telephones in rural towns. People relied on horses for transportation and candles for lighting. While the railroad system had started expanding across the country, it had not yet reached many small towns like Shrewsbury.

Social life revolved around family, church, and community events. Education was limited, with many children attending one-room schoolhouses. Access to higher education was scarce, particularly for those from low-income families. Jesse Livermore’s upbringing in Shrewsbury during the 1870s played a crucial role in shaping his character and his future aspirations. The limitations of his rural upbringing and the desire to escape poverty fueled his determination to succeed in the world of finance, ultimately propelling him to the heights of Wall Street success.

A Glimpse into the Past: Exploring Jesse Livermore’s 1877 Shrewsbury and the Foundations of a Trading Empire

Jesse Livermore’s early life in Massachusetts played a crucial role in shaping his trading career. He grew up in a farming family in a rural area. His father, who was a farmer, had hoped that young Jesse would follow in his footsteps. However, Livermore had other plans.

From a young age, Jesse displayed a keen interest in finance and numbers, which led him to leave his family’s farm at the age of 14. He moved to Boston, where he found work as a board boy in a stock brokerage firm, Paine Webber. In this role, he diligently recorded stock prices and transactions on a chalkboard, which exposed him to the world of stocks and trading.

This early exposure to financial markets fueled Livermore’s passion for trading, and he quickly realized he had a knack for predicting market trends. He began to trade for himself using the little money he had saved. By the age of 20, Livermore had become proficient in trading and had earned a reputation as a skillful trader.

Livermore’s humble beginnings in Massachusetts and his early experiences in Boston’s financial district set the stage for his meteoric rise in the world of finance. His innate talent for trading, coupled with his relentless drive for success, allowed him to overcome the limitations of his background and become one of the most renowned stock traders in history.

The early life of Jesse Livermore is a testament to the power of resilience, determination, and a willingness to challenge conventional wisdom.

The early life of Jesse Livermore is a testament to the power of resilience, determination, and a willingness to challenge conventional wisdom. His story serves as an inspiration to aspiring traders, reminding them that even the most humble beginnings can give rise to greatness. The legend of Jesse Livermore, the trading prodigy, will continue to captivate and motivate generations to come.

Learning by Doing: The Inspirational Education of Jesse Livermore, the Trading Mastermind

Jesse Livermore did not receive a formal education due to a combination of factors, including his family’s financial situation and the need to contribute to the household income from a young age. Born in 1877 in Shrewsbury, Massachusetts, Livermore grew up in a working-class family that could not afford to send him to school for an extended period.

Jesse Livermore was a self-taught genius who rose from humble beginnings to become a legend on Wall Street. Despite his lack of formal education, Livermore’s innate ability to analyze markets and make trades transformed him into a successful trader.

Forging His Own Path: The Self-Taught Journey of Jesse Livermore and His Impact on the Trading World

Born in Shrewsbury, Massachusetts, Livermore had no opportunity for higher education. He left home at the age of 14 and headed to Boston to make a living. It was there he found a job as a board boy at Paine Webber, a brokerage firm. This was the beginning of Livermore’s journey into the world of stocks and trading.

Instead of formal schooling, Livermore learned through hands-on experience, observation, and trial-and-error. He spent countless hours studying the price movements of stocks, eventually discovering patterns that would guide his trading decisions. As a young trader, Livermore spent his spare time reading financial newspapers, absorbing everything he could about the stock market and the economy.

Livermore’s unique, self-taught approach to trading led him to develop several groundbreaking strategies, such as trading on margin and short selling. He also understood the importance of market psychology and risk management, which he applied in his trading.

Over time, Livermore built his fortune through perseverance and learning from his mistakes. He experienced both incredible wins and devastating losses, yet never gave up. His ability to adapt and improve his trading strategies allowed him to bounce back from setbacks and achieve great success.

Jesse Livermore’s story serves as an inspiration for those who want to excel in the trading world.

Jesse Livermore’s story serves as an inspiration for those who want to excel in the trading world. It is a testament to the power of determination, self-education, and learning from experience. Aspiring traders can take a page from Livermore’s book, focusing on continuous learning and adapting to changing market conditions to achieve their own success in the world of finance.

Young and Ambitious: How Jesse Livermore’s Early Life Set the Stage for His Legendary Trading Career

Jesse Livermore’s early life was marked by humble beginnings and a strong desire to learn and succeed. Born into a working-class family, he experienced a childhood defined by the realities of the time: limited financial resources and the necessity to contribute to the family income from a young age.

Jesse Livermore’s early home life was shaped by the modest circumstances of his family. He was one of several children. His father, George Livermore, worked as a farmer to provide for the family, while his mother, Sarah Elizabeth Livermore, was a homemaker. In such a working-class family, children were often expected to contribute to the family income from a young age.

Livermore’s early life was characterized by determination, hard work, and an unrelenting drive to succeed. These qualities, combined with his innate intelligence and talent for trading, set the stage for his eventual rise to prominence as one of the most renowned and influential stock traders in history.

Given the financial constraints and the need to support the family, Jesse Livermore did not have the opportunity to pursue a formal education beyond a basic level. This likely affected his family relationships, as he was eager to break free from the constraints of his upbringing and pursue a life beyond farming. His decision to leave home at the age of 14 to seek better opportunities in Boston might have been met with mixed emotions from his family, but it ultimately allowed him to embark on a path that would lead to his legendary career in the stock market.

Mastering the Market: The Astounding Career of Jesse Livermore, Wall Street’s Trading Titan

The fascinating story of Jesse Livermore, a self-made trading titan, is one that has captivated generations of traders and investors alike. Born into humble beginnings, Livermore left home at 14 to pursue a life beyond farming. Little did he know that his journey would lead him to become one of the most legendary traders in the history of Wall Street.

Livermore’s career began in the “bucket shops” of Boston, where he honed his trading skills by betting on stock prices. His innate ability to spot trends and anticipate market movements soon gained him a reputation as an astute trader. By the time he moved to New York City in 1900, Livermore had already amassed a small fortune.

In the early 20th century, Livermore’s fame skyrocketed as he successfully predicted and profited from major market events such as the Panic of 1907, the 1929 stock market crash, and the subsequent Great Depression. His trading prowess was unmatched, earning him the nickname “The Great Bear of Wall Street” and a fortune estimated to be worth over $100 million at its peak.

Yet, Livermore’s career was not without its ups and downs. He endured multiple bankruptcies and comebacks, proving that even the most skilled traders face challenges. His perseverance and ability to learn from his mistakes served as a testament to his tenacity and passion for trading.

A Costly Lesson: How Jesse Livermore’s Union Pacific Corner in 1907 Shaped His Future Trading Strategies

- The 1907 Union Pacific Corner

- In 1907, Livermore tried to corner the market on Union Pacific Railroad stock. However, the market went against him, resulting in substantial losses. Livermore was forced to declare bankruptcy, and the episode taught him the importance of cutting losses quickly.

In the early 20th century, Jesse Livermore was already a force to be reckoned with in the world of stock trading. The young trader had built a reputation for his daring bets and uncanny ability to read market trends. However, even the great Livermore was not immune to setbacks. One of the most notable incidents in his career was the 1907 Union Pacific Corner, which resulted in his first major bankruptcy.

The stage was set in the midst of a severe financial panic that struck the United States in 1907. Amidst the chaos, Jesse Livermore saw an opportunity to profit by cornering the market on Union Pacific Railroad stock. At the time, Union Pacific was a major player in the American railroad industry, and Livermore believed he could capitalize on the panic-driven market fluctuations.

Livermore began accumulating shares of Union Pacific, driving up the price and creating a short squeeze on the stock. His plan was to force other traders to buy back their short positions at increasingly higher prices, thereby profiting from their desperation.

However, Livermore’s plan soon unraveled. E.H. Harriman, a prominent railroad magnate, and his associates also began buying up Union Pacific shares, effectively taking control of the stock. As a result, Livermore found himself in a precarious situation, unable to cover his positions and ultimately facing bankruptcy.

The 1907 Union Pacific Corner was a humbling experience for Livermore, but it was far from the end of his storied career. In fact, the lessons he learned from this debacle helped him refine his trading strategies, ultimately leading to even greater success in the future.

Livermore’s experience with the Union Pacific Corner serves as a cautionary tale for traders

Livermore’s experience with the Union Pacific Corner serves as a cautionary tale for traders, emphasizing the importance of risk management, adaptability, and humility in the face of market forces. By understanding and learning from the failures of the past, modern traders can better navigate the complexities of today’s financial markets.

From Turmoil to Triumph: Jesse Livermore’s Daring Strategies in the Face of the 1912 Stock Market Break

- The 1912 Stock Market Break

- Livermore suffered significant losses during a stock market downturn in 1912. Over-leveraging his investments and failing to follow his own rules about risk management contributed to his financial decline. This bankruptcy led Livermore to refine his trading strategies and take a more cautious approach to risk.

Jesse Livermore was no stranger to the ebbs and flows of the stock market. By 1912, he had already faced significant challenges in his career, including the 1907 Union Pacific Corner. Yet, Livermore continued to refine his trading strategies and solidify his reputation as a Wall Street titan. One of his most impressive feats during this period was successfully navigating the turbulent 1912 stock market break.

In the early months of 1912, the stock market was experiencing a period of rapid growth. However, this seemingly unstoppable upward trend was soon met with a sudden and unexpected downturn. Stock prices plummeted, and investors panicked as the market faced a significant break.

Amidst this chaos, Jesse Livermore demonstrated his uncanny ability to read market trends and take calculated risks. While many traders were blindsided by the sudden drop, Livermore had anticipated the possibility of a market reversal. He acted strategically, selling his long positions and going short just before the downturn hit.

Livermore’s foresight and skillful maneuvering in the 1912 stock market break not only protected him from substantial losses but also generated sizable profits. As other traders scrambled to make sense of the collapsing market, Livermore stood out as a shining example of financial acumen.

The 1912 stock market break serves as a testament to Jesse Livermore’s incredible talent and perseverance in the face of adversity. His ability to adapt to market conditions and make bold decisions in moments of crisis distinguished him as a true master of the trading world.

Livermore’s success during the 1912 stock market break offers valuable lessons for modern traders. By focusing on careful analysis, understanding market psychology, and maintaining discipline, traders can navigate the uncertain waters of financial markets and emerge victorious, just as Livermore did over a century ago.

Weathering the Storm: How Jesse Livermore’s 1934 Bankruptcy Shaped the Legendary Trader’s Resilient Approach to Financial Markets

- The 1934 Bankruptcy

- After the 1929 stock market crash, Livermore struggled with maintaining his fortune due to personal issues, including a costly divorce, and a lack of discipline in his trading. In 1934, he declared bankruptcy once again, losing nearly all of his assets.

In the world of stock trading, few names are as prominent as that of Jesse Livermore. His meteoric rise to fame and fortune is the stuff of legend. However, even the greatest traders experience setbacks, and Livermore was no exception. The 1934 bankruptcy is a significant chapter in his life, serving as a stark reminder of the volatility and uncertainty that accompany the world of finance.

By 1934, Livermore had already experienced a rollercoaster of successes and failures. The Wall Street Crash of 1929 had left him on the winning side, as he successfully shorted the market, amassing a fortune. However, the years that followed saw his personal and financial life unravel, culminating in his filing for bankruptcy in 1934.

A combination of factors contributed to Livermore’s financial downfall in 1934. His increasingly lavish lifestyle, marked by excessive spending and a string of expensive divorces, began to erode his fortune. Meanwhile, in the trading world, Livermore’s once-golden touch seemed to falter as he made a series of ill-advised trades and failed to adapt to the changing market conditions brought on by the Great Depression.

Despite these setbacks, Livermore’s story did not end in failure. As a testament to his unwavering resilience and determination, he made a remarkable recovery following his 1934 bankruptcy. By adjusting his trading strategies and reevaluating his approach to risk management, Livermore would go on to regain his former success in the markets.

The 1934 bankruptcy of Jesse Livermore serves as a cautionary tale for traders, highlighting the importance of discipline, adaptability, and prudent risk management.

The 1934 bankruptcy of Jesse Livermore serves as a cautionary tale for traders, highlighting the importance of discipline, adaptability, and prudent risk management. Yet, his remarkable recovery also stands as a testament to the resilience and determination that define the spirit of a true market legend.

These bankruptcies highlight the volatile nature of Livermore’s trading career and the risks associated with his aggressive strategies. While he achieved significant financial success at various points, he also faced substantial losses due to a lack of discipline and an inability to consistently manage risk.

Jesse Livermore’s meteoric rise to fame and his incredible resilience in the face of adversity make his career an enthralling tale of ambition, innovation, and the relentless pursuit of success. His legendary status in the world of trading will forever remain an inspiring example for those who aspire to conquer the ever-challenging stock market.

One of the key elements to Livermore’s successful trading career was his innovative trading methodologies. He developed his own set of rules and principles, which included understanding market psychology, using price and volume analysis, identifying pivotal points, and maintaining discipline. These techniques have left an indelible mark on the world of trading and continue to inspire traders today.

Jesse Livermore Uncovered: Exploring the Lesser-Known Aspects of the Legendary Trader’s Personal Journey

- Philanthropy

- Despite his reputation as a ruthless trader, Livermore was known for his philanthropy. He quietly donated substantial sums of money to various causes, including hospitals and orphanages.

- Multiple marriages

- Jesse Livermore was married three times. His first marriage was to Nettie Jordan, with whom he had a son. His second marriage was to Dorothea “Dorothy” Wendt, with whom he had another son. His third and final marriage was to Harriet Metz Noble.

- Passion for yachting

- Livermore had a great passion for yachting and owned several luxurious yachts throughout his life. He used them as a means to escape from the pressures of Wall Street and spend quality time with his family and friends.

- Attempted kidnapping

- In 1935, Livermore’s youngest son, Jesse Livermore Jr., was the target of an attempted kidnapping. Fortunately, the kidnappers were caught, and his son was unharmed.

- Love for fine arts

- Livermore was an avid collector of fine art and antiques. His luxurious homes were adorned with exquisite paintings and artifacts, reflecting his refined taste and appreciation for beauty.

- Health struggles

- Livermore struggled with various health issues throughout his life, including depression and alcoholism. These struggles contributed to his personal and professional ups and downs.

- Friendship with Bernard Baruch

- Livermore maintained a close friendship with the famous financier and statesman, Bernard Baruch. Both men shared a passion for the stock market and often exchanged ideas and strategies.

- Interest in spiritualism

- Livermore had a fascination with spiritualism and was known to consult psychics and mediums. He once credited a medium with helping him make a successful trade during a séance.

Beyond the Trading Floor: An Intimate Glimpse into Jesse Livermore’s Personal Life and Marriages

Jesse Livermore was married three times.

- Nettie Jordan

- His first marriage was to Nettie Jordan, with whom he had a son.

- Dorothea “Dorothy” Wendt

- His second marriage was to Dorothea “Dorothy” Wendt, with whom he had another son.

- Harriet Metz Noble

- His third and final marriage was to Harriet Metz Noble.

Love Amidst Market Swings: Jesse Livermore’s First Marriage to Nettie Jordan and its Impact on His Legendary Trading Career

Jesse Livermore’s first marriage was to Nettie Jordan, a woman he met while working as a stockbroker in Boston. The couple married in the late 1890s, when Livermore was in his early 20s. They had a son named Jesse Livermore Jr., who was born in 1901. However, the marriage was short-lived, and Jesse and Nettie eventually divorced in 1917.

There isn’t much publicly available information about Jesse’s relationship with his first wife, Nettie, and their son, Jesse Jr. However, it is known that Jesse Jr. grew up to follow in his father’s footsteps and pursued a career in trading. Unfortunately, Jesse Jr. faced his own set of challenges, including legal troubles and financial setbacks, which ultimately led to his own suicide in 1975.

Not much is publicly known about the details of their marriage, but it is said that Nettie Jordan was a supportive wife, standing by Livermore during the initial years of his career when he faced financial hardships. However, their marriage did not last, and the couple eventually divorced.

The Ties That Bind: How Dorothy Wendt’s Loyalty Shaped Jesse Livermore’s Personal and Professional Life

Jesse Livermore’s marriage to Dorothea “Dorothy” Wendt, his second wife, began in 1918. Dorothy was the sister of Livermore’s close friend, Walter E. Wendt, who was also a prominent stock trader at that time. The couple shared a glamorous lifestyle, often attending high-society events and living in luxurious homes. Dorothea “Dorothy” Wendt, a beautiful Ziegfeld Follies showgirl

Dorothy was known for her extravagant lifestyle and expensive tastes, which led the couple to live quite lavishly during their marriage. They owned numerous homes, including their main residence, a luxurious mansion in Great Neck, New York, and a sprawling estate in Lake Placid, Florida. Jesse’s success in the stock market allowed the family to maintain their opulent lifestyle for many years.

However, as Jesse’s fortunes began to fluctuate, tensions grew between him and Dorothy, eventually leading to their divorce in 1932. Jesse’s relationship with his sons, especially Jesse Jr., who had also chosen a career in trading, seemed to be strained over time, with Jesse Jr. experiencing his own financial and personal challenges.

Overall, Jesse Livermore’s marriage to Dorothy Wendt was marked by extravagance, but it also experienced turbulence due to the ups and downs of his career in the stock market.

Jesse and Dorothy had one son Paul Livermore As for Paul Livermore, not much is publicly known about his life, as he seemed to have maintained a lower profile compared to his brother, Jesse Jr. It is unclear if Paul pursued a career in trading or chose a different path.

Despite the challenges faced by Jesse Livermore’s sons, their father’s legacy in the world of finance and trading remains unparalleled, leaving a lasting impact on generations of traders to come.

Their marriage, however, was tumultuous, with the couple experiencing ups and downs in their relationship due to Livermore’s preoccupation with the stock market and his infidelities. The couple had two sons together, Jesse Jr. and Paul. Despite the challenges, Dorothy stood by Livermore during some of the most difficult times in his career, including his multiple bankruptcies.

Despite their separation, it is believed that Dorothy remained loyal to Livermore and continued to support him emotionally, even after their divorce.

In 1932, the couple’s marriage ended in divorce, partly due to Livermore’s financial troubles and personal issues. Despite their separation, it is believed that Dorothy remained loyal to Livermore and continued to support him emotionally, even after their divorce. Livermore’s marriage to Dorothy Wendt is often seen as an important aspect of his personal life, with their relationship reflecting the rollercoaster ride of his trading career.

Finding Solace Together: The Unraveling Tale of Jesse Livermore’s Relationship with Harriet Metz Noble

Jesse Livermore’s marriage to Harriet Metz Noble marked his third and final marriage. Harriet, a wealthy widow who was previously married four times, tied the knot with Jesse in 1933. Despite the challenges that Jesse faced in his professional and personal life, Harriet remained supportive of her husband.

The couple faced financial difficulties together, including the 1934 bankruptcy that wiped out much of Jesse’s fortune. However, Harriet’s own wealth was relatively secure since it was separate from Jesse’s finances. Their marriage continued until Jesse’s tragic suicide in 1940.

While there isn’t much public information available about the intricacies of their relationship, it’s clear that Harriet Metz Noble played a significant role in Jesse Livermore’s final years.

The Stock Trader The Bear of Wall Street Who Did Jesse L. Livermore Influence? How Did the White House Affect Jesse L. Livermore’s Trading? How Did J.P. Morgan Influence Jesse L. Livermore? What’s so interesting About Jesse Livermore?

Born: Jesse Lauriston Livermore July 26, 1877 Shrewsbury, Massachusetts, U.S. Died: November 28, 1940 (aged 63) New York City, U.S. Cause of death: Suicide by gunshot Other names: Boy Plunger, The Wolf of Wall Street, The Great Bear of Wall Street Occupation: Stock trader Spouses: Nettie Jordan (m. 1900; div. 1917) Dorothea “Dorothy” Wendt (m. 1918; div. 1932) Harriet Metz Noble (m. 1933: div. —-) Children 2

Marriages: “Love and Wall Street: Jesse Livermore’s Turbulent Marital Journey Amidst a Legendary Trading Career” “Beyond the Trading Floor: An Intimate Glimpse into Jesse Livermore’s Personal Life and Marriages” “The Romantic Side of a Stock Market Icon: Unveiling the Intriguing Story of Jesse Livermore’s Multiple Marriages” Publications: “Jesse Livermore’s Timeless Wisdom: Exploring the Enduring Legacy of His Groundbreaking Trading Publications” “From Wall Street Maverick to Published Authority: How Jesse Livermore’s Books Shaped Generations of Traders” “The Written Legacy of a Trading Titan: Unearthing the Secrets to Success in Jesse Livermore’s Influential Publications” Death: “The Mysterious Demise of Jesse Livermore: Wall Street’s Iconic Trader and the Final Chapter of His Life” “Tragic End of a Wall Street Legend: Uncovering the Untold Story of Jesse Livermore’s Final Days” “From Trading Fame to Tragic Fate: A Deep Dive into the Enigmatic Death of Jesse Livermore and Its Impact on the World of Finance”

Excited by What You've Read?

There's more where that came from! Sign up now to receive personalized financial insights tailored to your interests.

Stay ahead of the curve - effortlessly.